Bitcoin’s Best Buy Zone in 2025: Smart Money Analysis (Charts Inside)

Thinking about buying Bitcoin in 2025? Hold up — jumping in at the wrong level could slash your profits by 50% or worse… send your stop loss straight into oblivion.

I’m already partially positioned for long-term holding, but in this article, I’ll break down what I’m planning for additional buys and possible swing trades — based on what the chart is showing me and, more importantly, what the big players (aka the sharks) are doing.

According to Smart Money Concepts (SMC), institutions accumulate BTC in specific discount zones — areas that most retail traders ignore, panic about, or just don’t understand. In this guide, you’ll discover:

✅ The top low-risk entry zones for 2025 based on historical Order Blocks and liquidity data.

✅ Confluences that strengthen those Order Blocks, like Volume Profile hot zones and key Fibonacci levels.

✅ When to actually pull the trigger — exact confirmation signals using SMC (like CHoCH with volume spikes).

I’ve been applying this exact framework to Bitcoin charts since 2020 — and the results have been consistently solid. Let’s break down the current market and find the next perfect entry.

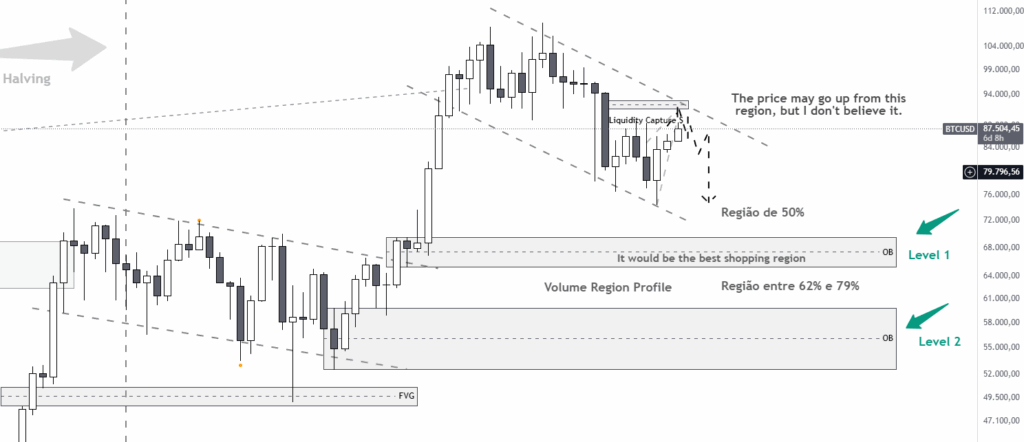

Weekly chart version of analysis.

(image credits, TradingView chart)

What I’m Seeing on the Chart I don’t believe Bitcoin is kicking off its next bull run from the current $87,500 zone. What I find more likely is a short-term pump up to around $92,000 — where we’ve got a 4H bearish Order Block lining up with a descending trendline (LTB) acting as a correction channel.

Is this a prediction? Nope. It’s a plan. A strategic scenario so I’m ready to react. If it doesn’t play out? I adapt. We don’t predict the market — we prepare and adjust.

After a potential short-term pump to $92k, I expect a continuation of the correction to Level 1, which I see as the prime buy zone:

📍 High Volume Profile region

📍 Confluence with the 61.8% Fibonacci retracement

📍 Major liquidity zone

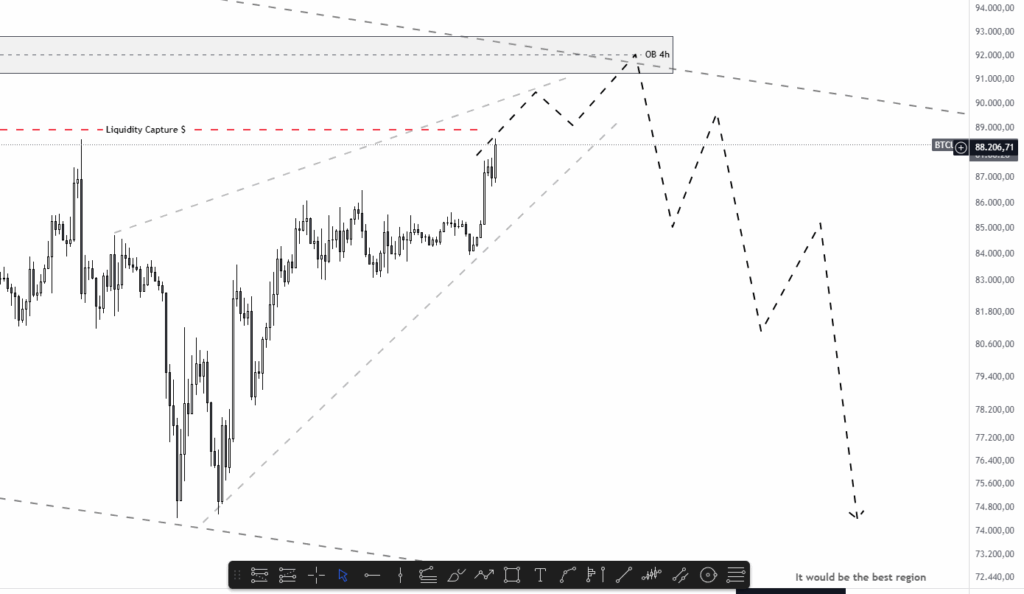

Same analysis on the 4h Chart.

(image credits, TradingView chart)

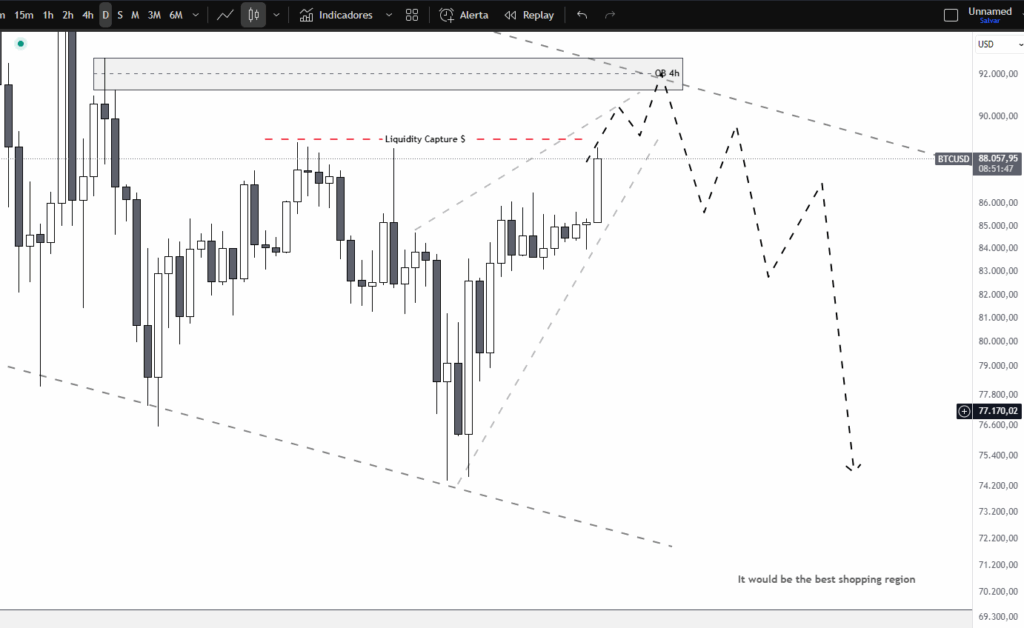

Check out the image below showing the daily chart setup. The idea: liquidity grab around $89,000, tag the 4H OB, and then dump to around $67,000.

Daily Chart.

Confira a imagem abaixo mostrando a configuração do gráfico diário.

A ideia: a liquidez deve atingir cerca de US$ 89.000, atingir o OB de 4 horas e então cair para cerca de US$ 67.000.

(image credits, TradingView chart)

Fundamental Analysis: Aligning with the Chart

I always keep an eye on fundamentals too. And guess what — data from BCA Research backs up this technical outlook.

Who is BCA Research?

Founded in 1949, BCA is a global leader in macroeconomic analysis — followed by top funds and asset managers. When they speak, it’s worth listening.

Their long-term outlook for Bitcoin is bullish:

🟢 Store of Value: They expect BTC to solidify as a protection asset, especially with ETF adoption growing.

🟢 Price Target: Their long-term forecast sees BTC hitting $200,000 in upcoming cycles.

🔴 Short-Term Caution: They recommend profit-taking at highs and warn of risks in retail — memecoins, FOMO, and overleverage.

🔍 Here’s the kicker: they see $75,000 as a solid re-entry level — right where we also have a strong Order Block.

Technical SMC Signals: How to Know When to Act

For those not familiar, here are some key Smart Money Concepts:

Order Block (OB): The last bullish candle before a big dump (or last bearish candle before a pump) — zones where institutions often load up.

CHoCH (Change of Character): A clear shift in market structure — e.g., from lower highs to higher highs — signaling potential reversal.

BOS (Break of Structure): Breaking a previous swing high or low — confirming strength in the move.

Pro tip:

If you’re thinking about entering on an Order Block, wait for triple confirmation:

📊 Unusual volume

📈 CHoCH

📉 Strong candle close

Risk Management: Because Gains Without Risk Control Are an Illusion.You might nail the move — but if you botch risk management, even a great trade can wreck your account.

My personal rule:

Never go all-in at one price. I ladder into zones — and only scale in heavy when I get confirmation via SMC + favorable macro context.

Avoid obvious stop placements:

Putting your stop just below the OB? That’s basically an invitation to the whales. Place it where they’re not hunting — think like a predator, not prey.

Risks on the Radar: Stay Sharp

U.S. Government BTC Reserves:

There’s potential for a massive dump from U.S. government BTC reserves. If that hits, expect violent drops — we’ve seen it happen before.

Risks on the Radar: Stay Sharp

Memecoins & Politics:

Trump dropping a memecoin, retail hype, and volatility in Congress over the Bitcoin Act 2025 — this calls for extra caution.

Liquidity pools near $85K could turn into stop-loss magnets.

Final Take & #ProTip

I don’t box myself into labels: I’m not purely technical or purely fundamental.

I go with what works.

This analysis is a map — it keeps me calm and calculated, not reactive.

Want to grow consistently? Then remember:

Plan. Confirm. Then execute.

This isn’t a bar brawl — it’s high-level chess. ♟

Your next sniper entry might be around $67K or $75K — but let the price confirm it.

Keep Leveling Up

Join my email list for weekly chart breakdowns + SMC-driven studies.

Check out more posts on the blog — there’s tons of straight-to-the-point content for traders looking to level up with consistency.

See you on the next chart.

Disclaimer: The content on this page is for educational and informational purposes only and does not constitute investment advice. Trading cryptocurrencies involves high risk, and you should consult a financial advisor before making any decisions. We are not responsible for any financial losses.

Want more tips like these? Join our email list for weekly crypto insights! 📩

Awesome!