The Power of Liquidity: How to Win 80% of Trades Using High-Probability Zones

Have You Ever Felt Like the Market Was "Chasing" You?

If you’ve ever spent hours analyzing charts, studying news, and searching for fundamental confirmations,

only to see the market go exactly against your position — know that you’re not alone.

That frustrating feeling was very familiar to me too.

For a long time, I thought I simply wasn’t good enough —

after all, how could I study so much and still lose?

What I didn’t know back then was that I was missing a critical piece of the puzzle:

understanding the real fuel that drives the market — liquidity.

More specifically: external and internal liquidity.

When that realization hit me, it was like putting eye drops into blurry eyes:

suddenly, chart reading became much clearer.

Understanding the Market's Fuel

The financial market is like a giant machine that needs energy to move.

And that energy is liquidity — money trapped at strategic points on the chart.

Just like a car needs fuel to run,

price needs to capture liquidity to keep moving.

When the “tank” runs empty, price must return to “refuel” — it’s that simple.

And here’s the key:

Institutional traders know exactly where that liquidity is.

They hunt the liquidity left behind by retail traders —

stop-loss orders, pending orders, and impatient breakout entries.

Training your eyes to spot these movements is what puts you in sync with the liquidity hunters — no longer the prey.

🔎 What Is External Liquidity and Internal Liquidity?

Let’s make this even clearer:

External Liquidity

Imagine precious jewels left exposed in obvious places.

External liquidity sits above obvious highs and below obvious lows on the chart —

areas where many traders place their stop-losses or breakout orders.

Classic examples:

Stops above the last high.

Stops below the last low.

Institutions know this — and price, like a seasoned treasure hunter, goes after these “exposed jewels.”

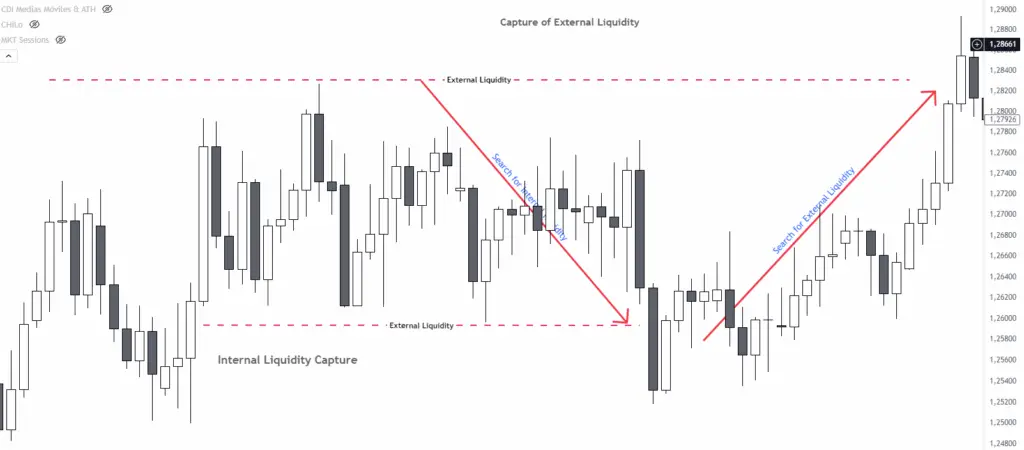

See the example in the chart below:

Notice how price hits exactly where the stops were clustered, captures the liquidity, and then reverses direction.

(Credits, image from TradingView)

Notice how price hits exactly where the stops were clustered, captures the liquidity, and then reverses direction.

Prosperity vs. Wealth in Trading

Internal Liquidity

Now, think of treasures hidden deeper inside the structure.

Internal liquidity is trapped within the price structure —

between highs and lows, in more subtle zones.

It hides inside:

Accumulation ranges.

Fake breakout patterns.

Consolidation zones.

These areas also contain trapped money —

and sooner or later, the market will detect and hunt it down.

See the example in the chart below:

(Credits, image from TradingView)

Notice how, even within the structure, price returns to capture hidden liquidity before making its real move.

How to Use Liquidity to Your Advantage

The big secret is:

Don’t fight the market — follow the liquidity hunters.

Here are 3 key points:

Notice where most traders are likely to be placing their stops.

Wait for the market to grab that liquidity before looking for entries.

Think like an institution, not a retail trader.

When you learn to see liquidity,

you stop being manipulated —

and start trading with strategic intelligence, my dear!

Conclusion: Developing the Hunter's Eye

Just like the old hunter trusts his gear to find buried treasures,

you can trust your knowledge of liquidity to find hidden opportunities.

The market is not against you.

It’s simply chasing the fuel it needs to move.

Learn to think like the market —

and you’ll stop being the prey…

and start becoming the hunter.

Stay tuned!

In the next article, we’ll dive into how to identify liquidity zones by combining market structure and order blocks.

Be the first to comment!