Why Can’t You Pull the Trigger on a Stop? The Psychology Behind Trade Attachment

The Drama of the Unclicked Button

This used to happen to me a lot — and I want to share how I overcame it.

Have you ever found yourself staring at a losing trade, knowing you should close it according to your risk management… but unable to click the button?

This isn’t just a lack of discipline.

It’s your brain going into identity defense mode — protecting your self-image as a trader.

Recognizing this mental pattern is the first step to disarming it.

The Sunk Cost Fallacy: Emotional Glue to Losing Trades

This doesn’t just happen in trading. It’s a well-documented cognitive bias: we tend to hold onto things simply because we’ve already invested time, money, or energy — even when logic says it’s time to walk away.

In the markets, the more you’ve “already lost” in a trade that’s going against you, the harder it becomes to exit.

The brain whispers:

“I’ve lost so much here already… if I close now, it’ll all be wasted.”

That distorted hope of “getting it back” locks you into a bad position, blinding you to the very real risk of losing even more.

It’s emotional attachment to the past, blocking a rational decision about the future.

Holding a Position Just to Get Back to Break-even

One of the mind’s favorite excuses is:

“Maybe I’ll just let this become a swing trade.”

But let’s be honest… that’s not real.

You may have both swing and day trading strategies — and that’s fine.

But each one must be clearly defined from the start: risk parameters, asset choice, leverage, volatility expectations.

Changing strategies mid-trade is a form of sabotage.

It’s not flexibility — it’s a violation of your plan.

The Ego in Trading: Understanding Is Everything

Ego is a challenge in any area of life.

But in trading, it gets expensive — very fast.

To the subconscious, admitting a mistake feels like ego death.

It would rather lose money than let go of the identity of “the trader who’s always right.”

“Admit you were wrong? That’s weakness.”

But here’s what neuroscience tells us:

The human brain hates to lose — even more than it loves to win.

It’s a primal survival reflex, born in an age when losing could literally mean death.

In this context, a 1% or 2% stop loss can feel like a major threat.

The ego steps in as the hero, defending your original idea — at any cost.

Confirmation Bias: The Hidden Saboteur

The mind filters, distorts, omits, and generalizes information.

It’s wired to protect your point of view — even when it’s wrong.

For example, when you’re long, you tend to ignore negative headlines.

When you’re short, you downplay good news.

This internal filter becomes dangerous in trading.

Self-Awareness Drill:

Before entering any trade, write down 3 reasons why your idea might be wrong.

Doing this forces your brain to see more objectively — and trains humility in decision-making.

Addicted to Being Right

Being right feels good. Especially when you’ve had a few solid wins, your brain gets used to that dopamine hit.

The problem?

That craving for confirmation makes it harder to accept losses.

You become emotionally invested — not just in the trade, but in being right.

The more your identity is tied to “winning,” the harder it becomes to let go when you’re losing.

Imagination Bias and the Dopamine Trap

Charts are often ambiguous. And when uncertainty hits, imagination fills the gap.

Here’s the twist:

The brain doesn’t fully distinguish between what’s real and what’s imagined — especially under the influence of hope.

That green candle forming?

Your brain instantly fires off dopamine, projecting the miraculous reversal.

This illusion feels rewarding — even when the market is telling a different story.

📊 A study showed: 72% of traders admit to delaying stops due to this imagined “turnaround hope.”

When Trading Becomes a Competition

Suddenly, it’s no longer a trade — it’s a battle.

“The market is trying to beat me… I’ll show it.”

This ego-driven mindset turns trading into a personal duel.

You double down. You hold longer. You fight the chart.

The market, of course, doesn’t care.

This mental war — trader vs. market — is not only exhausting…

It’s often what destroys accounts.

💎 Achieve emotional excellence in your negotiations, subscribe to our list, get updated now and increase your profits! Read also: “Mistakes that Sabotage New Traders: How to Overcome Fear and Boost Profits”

How to Break the Pattern

3 NLP-Based Techniques to Rewire Your Trading Behavior

1. The Neutral Observer Technique

Ask yourself:

“If this were my student, what would I tell them right now?”

Visualize two versions of yourself:

One is the impulsive trader, staring at the chart.

The other is the wise, seasoned version of you — the Trader Master.

Now speak from the voice of the master:

“Stick to your plan. Great strategists know when to retreat in order to win.”

Use metaphors if needed:

“David did not defeat Goliath with brute force — he used precision and centrifugal force, bringing Goliath to his own turf, not the turf of force where Goliath would surely defeat him.

In negotiation, your strength is not in stubbornness… it is in risk management.”

This technique creates distance from the emotional charge — and brings clarity back.

2. Identity Anchoring Statements

Use declarations that anchor your identity to discipline and detachment:

“Exiting at my stop is my strategic edge.”

“I am a wise strategist. It may look like a loss now, but I win in the long run.”

“The market doesn’t pull me away from my strategy.”

These statements operate at the deepest level of belief — your identity.

They reprogram how you see yourself in action. Learn more about this in Neurological Levels of NLP.

The goal?

To stop seeing a stop loss as a defeat… and start seeing it as a victory of integrity.

3. Learn from a Trading Robot

Watch an algorithm in action.

What you’ll see is pure strategy — no fear, no hope, no ego.

A robot stops when the system says to.

It holds a trade based on logic — not emotion.

And when the next entry comes? It takes it, clean and neutral.

It doesn’t hesitate. It doesn’t flinch.

The robot teaches us detachment, humility, and emotional discipline.

It may take two or three losses.

But then comes one well-executed win — and it makes it all worth it.

That’s not magic. That’s math + mindset, free from emotional noise.

We don’t need to trade like robots.

But we can learn to manage ourselves like one.

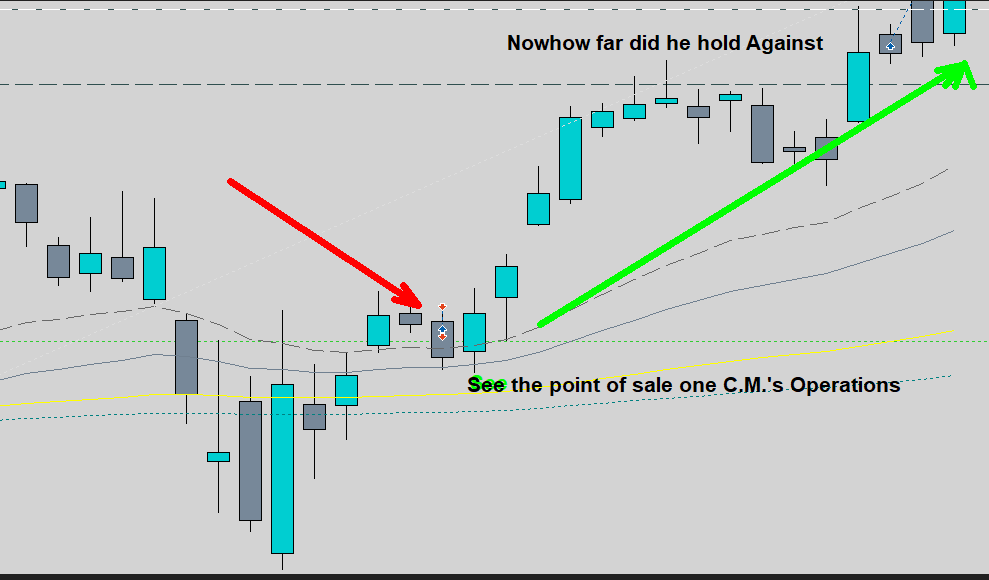

Real Case: When Emotional Attachment Became Expensive

One of my coaching clients — let’s call him C.M. — lost 48% of his account.

Enough to buy a brand-new car.

He held onto three losing trades, each one deeper than the last.

But the problem wasn’t technical. It wasn’t even a lack of strategy.

It was emotional attachment.

It was the illusion of control.

It was the absence of self-awareness.

When we dug deeper in our sessions, we found the emotional root:

As a teenager, he was betrayed by a girlfriend.

He didn’t react. And he was shamed for it.

“You’re soft.”

“You should’ve hit that guy.”

“You’re weak.”

Since then, he rejected his calm, peaceful nature.

And in the markets, he entered what I call “prove-it mode.”

He wasn’t fighting the chart.

He was fighting an old version of himself.

Each stop loss wasn’t just a loss of money — it was a threat to a wounded identity.

(Real chart from C.M. authorized to share for study)

Conclusion: A Stop Is Not a Failure. It’s a Mark of Strategy.

Stopping out isn’t a sign of weakness.

It’s a sign of wisdom.

It means you’re not trading to protect your ego — you’re trading to do what’s right.

The best traders don’t win every time.

They lose small — and win big.

The emotional trader wins often… but loses catastrophically.

✅ If this article spoke to you, share it with someone who’s still struggling with trade attachment.

In the coming weeks, I’ll be sharing more real-life examples and techniques to help you master emotional control in trading.

Let’s evolve — not just as traders, but as human beings.

And the journey starts inside.

🚀 Ready to take the next step? Explore the full Trader Conscious Journey framework here.

Be the first to comment!