How to Trade Like the Whales: 5 SMC Strategies for Beginners (Explained)

The thing that impressed me most about SMC was learning about the fuel that really moves the market, liquidity, and then being able to avoid being it. Minimize mistakes and optimize trading like whales instead of being their prey? Smart Money Concepts (SMC) largely reveal how banks and institutions really move the markets — and now you can learn how too.

For beginners, the market can seem like a jungle (full of traps, false swings, and emotional rollercoasters). But for me, when you find that strategy, SMC is like a map.

In this guide, you will learn how to master 5 proven SMC strategies to:

✅ Identify smart money trails (order blockages, imbalances, and more).

✅ Avoid retail traps (liquidity exploitation, false breakouts).

✅ Trade with institutional-grade confidence (and good management) (mindset tips included!).

Psst: SMC isn’t just what you trade — it’s how you think. That’s why we’re going to combine mindset with price action (your secret advantage!).

Let’s get started!

SMC Trading Decoded: Step Up and See the Smart Money Wave 📚

Smart Money Concepts (SMC) provides insight to help you trade in tandem with whales—institutional players who create trends instead of following them. While retail traders get stuck in liquidity traps, not understanding the movement team, SMC reveals the hidden playbook through:

✅ Order Blocks: Zones where big money accumulates (your secret entry points!).

✅ Breakout Structure (BOS): The moment the market confirms a change in direction—identify it early and trade smarter, minimizing risk.

✅ Imbalances: Price gaps begging to be filled (high probability profit opportunities!).

Why I trust SMC practitioners:

As a trader and therapist and coach, I have been using SMC for a few years—especially Order Blocks (my favorite strategy!). It’s perfect for beginners because:

📊 Visual and Logical: No overly complicated indicators that confuse more than they clarify, just pure price action.

💰 High Reward Potential: Some setups offer a risk-reward ratio of 3:1 to 10:1 (yes, seriously!). Professional traders don’t trade halfway.

🎯 Truth Bomb: Hit rate is vanity – consistency + payout and risk management win the game.

Ready to try it out? Grab your TradingView chart (my favorite tool!) – let’s analyze 5 SMC strategies that actually work!

What are SMC's main trading strategies? 📚

SMC (Smart Money Concepts) flips traditional trading on its head: instead of chasing trends, you learn to trade alongside the institutions that create them. Back when I relied on traditional methods, I’d wait for everything to line up—indicators in sync, confirmation in place—and I’d jump in, only to realize the trend was already over. I was the liquidity, just playing the market’s counterparty.

I knew I had to find an answer. Of course, there were psychological factors at play, and as a therapist, I started digging into myself. Using NLP techniques, I explored my own patterns—I noticed that since childhood, I was often “left behind” in games, always a step late. So, I worked on healing that pattern to start seeing things ahead of time. That’s when I stumbled upon the incredible SMC method! Check out our blog’s Trader Psychology category—you’ll love the mysteries you’ll uncover there! 🧠

While retail traders fall into liquidity traps, SMC reveals the market’s true moves through 3 key concepts:

🔍 Order Blocks: Institutional buy/sell zones (your secret entry points).

⚡ Break of Structure (BOS): The exact moment the market shifts direction.

💰 Imbalances: Price gaps waiting to be filled (free profit opportunities!).

Why SMC Makes So Much Sense for Beginners

After years of using these strategies (especially Order Blocks—my #1 go-to!), here’s why they work:

👁️ Visual and Intuitive: No complicated indicators—just pure price action.

🧠 Logic Over Luck: Understand why prices move (not just how).

Pro Tip: Open your TradingView chart now—we’ll break down 5 real examples together! 📈

Strategy 1: Identifying Retest in Block Orders 💥

Trade with the whales, not against them.

What happens:

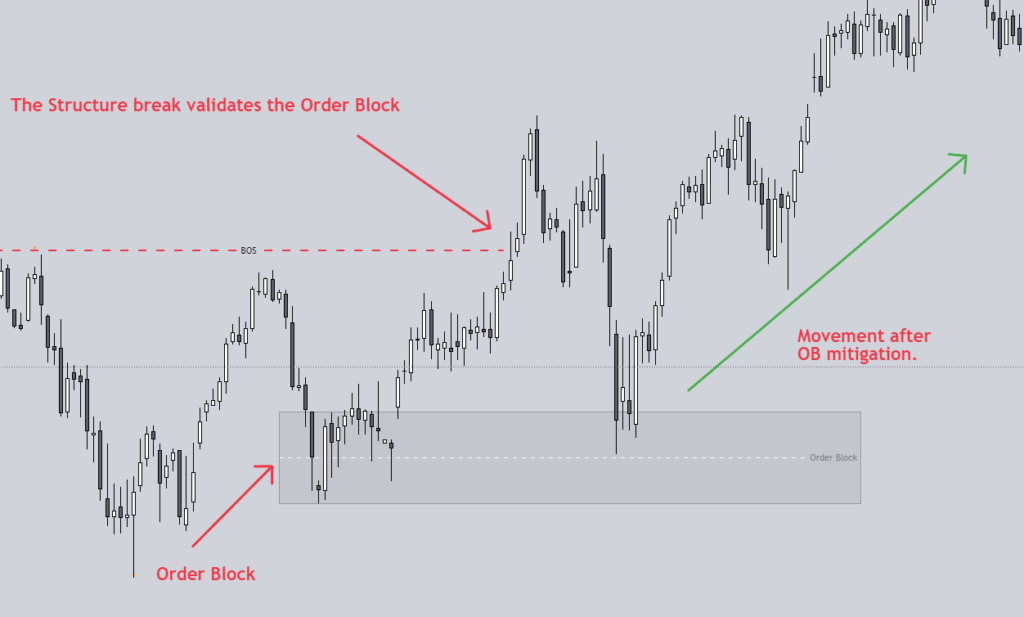

Block orders are the footprints of smart money — zones where price often reverses after a Structure Breakout (BOS).

How to trade (BTC/USD example):

1️⃣ Chart setup: 1-hour timeframe (ideal for identifying the clarity of the OB).

2️⃣ Identify the OB: Identify the last bearish candle before a strong rally (bullish OB). Mark it with a rectangle extending into the future (right of the chart).

3️⃣ Confirm the BOS: Price must break above the recent high. You won’t chase the price, your mark is down there, waiting for the retest.

4️⃣ Entry: Buy on the retest of the OB (with confirmation of the reversal candle close).

5️⃣ Risk Management: Stop Loss: Below the OB (invalidates the setup).

Take Profit: Closest imbalance or RR of 2:1.

🧠 Mindset tip:

“Whales test patience before inflating.” Follow the confirmations:

BOS + OB retest + volume spike help.

👉 Pro tip: Train, do a lot of backtests on TradingView or your preferred platform. With historical examples first, our mind learns by repetition (NLP)!

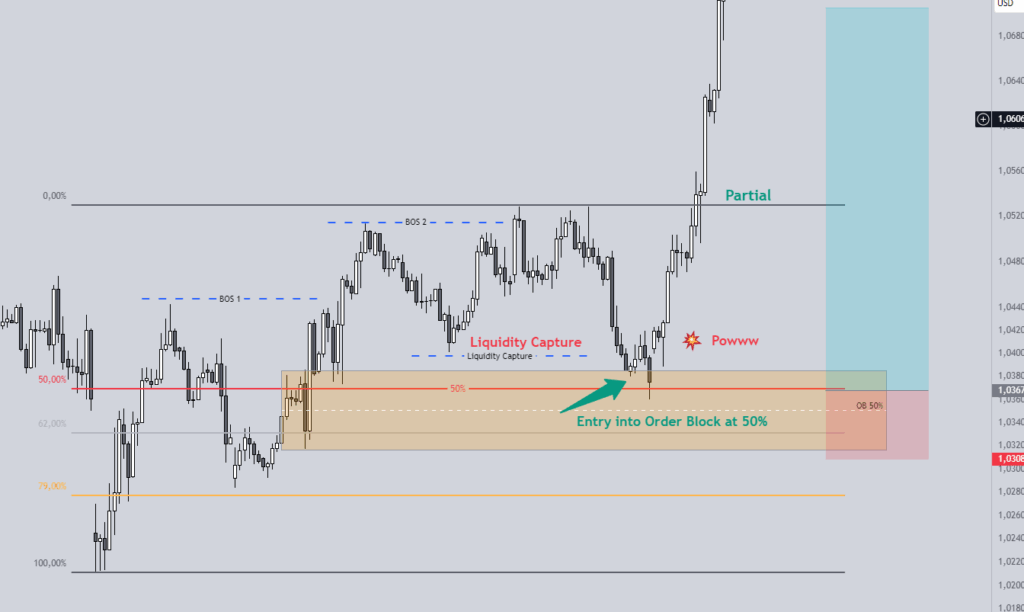

See the Example below:

(Image Credits TradingView, Dow Jones, May 2024 period)

Want more mindset tips? Check out our Trader Psychology articles!

💎 Pro Trader Secret: Combine SMC strategies with emotional mastery—read ‘How to Control Emotions in Trading’ and unlock your true edge. (Your psychology + smart money = unstoppable!)

Strategy 2: Liquidity Grab Reversal 🔄

“Profit by finding the market fuel.”

Why it works:

Smart money hunts retail stop-losses with false spikes — and then reverses strongly. Their mission: capture the snapback.

If after a consolidation there is a market trending up, but below that consolidation there is a high volume stop-loss. What is a stop-loss from someone who is long? Sell orders. OK? So what is the logic of the institutions: “I can buy more volume and cheaper below that consolidation, because there are players or other institutions selling there, and then explode higher.” Does that make sense?

Step by step (EUR/USD example):

1️⃣ Chart setup: 4-hour time frame (balances noise vs. signal).

2️⃣ Identify the trap:

Price swings below support (liquidity capture).

Immediate reversal candle (ideal hammer/pin bar or bull 180).

3️⃣ Confirm the move:

Bull order lock near original support.

Volume spike on reversal (whales buying).

4️⃣ Entry: Buy on OB retest with close confirmation.

5️⃣ Risk Rules:

Stop Loss: Below peak low (invalidates trap).

Take Profit: Previous resistance or at least 2×1 peak high.

🧠 Mindset Tip:

“Fear = liquidity fuel for smart investing.”

Pause. Ask: “Is this a trap or a trend?”

Trust the OB — it’s the whale’s real entry.

📉 Backtest Exercise:

Find historical liquidity captures and train your eye (e.g. EUR/USD in January 2024). Notice how the reversals respected the OBs.

(Image Credits TradingView)

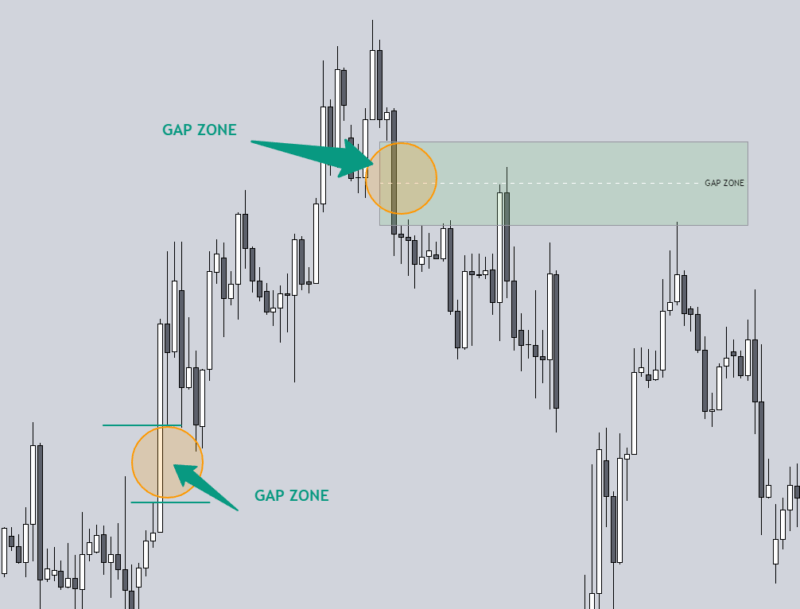

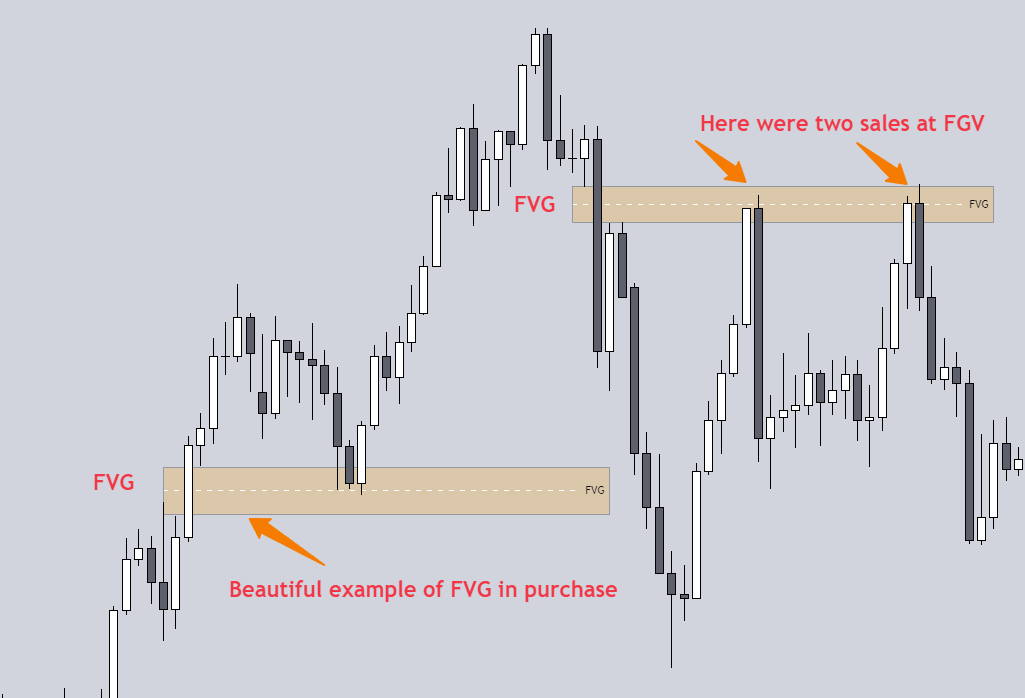

Strategy 3: Imbalance Fill Trade 📊

“Trade the market’s unfinished business.”

Why It Works:

Imbalances are price vacuum zones—smart money fills these gaps 80%+ of time (FX & commodities love this!). See an example in the image below:

(Image Credits TradingView)

Step-by-Step (XAU/USD Example):

1️⃣ Chart Setup: Daily timeframe (best for clean imbalance spotting).

2️⃣ Spot the Gap:

Look for space between candles after big moves (min. 1.5% price jump).

3️⃣ Wait for Retest:Price must touch the gap zone (not just near it).

4️⃣ Enter with Trend:Uptrend? Buy at gap + bullish OB confirmation.

Downtrend? Sell at gap + bearish OB confluence.

5️⃣ Risk Precision:SL: 1.5x gap size (beyond “fair value”).

TP: Previous swing high/low or 2:1 RR.

🧠 Mindset Hack:

“The market rewards those who wait—not those who chase.”

Set price alerts for gaps (no screen addiction).

Reject FOMO: “Missed fills recycle every 2-3 weeks.”

🔥 Pro Tip:

Gaps near weekly highs/lows fill fastest (check XAU March 2024!).

HTF Marking

(Image Credits TradingView)

Low entry period

(Image Credits TradingView)

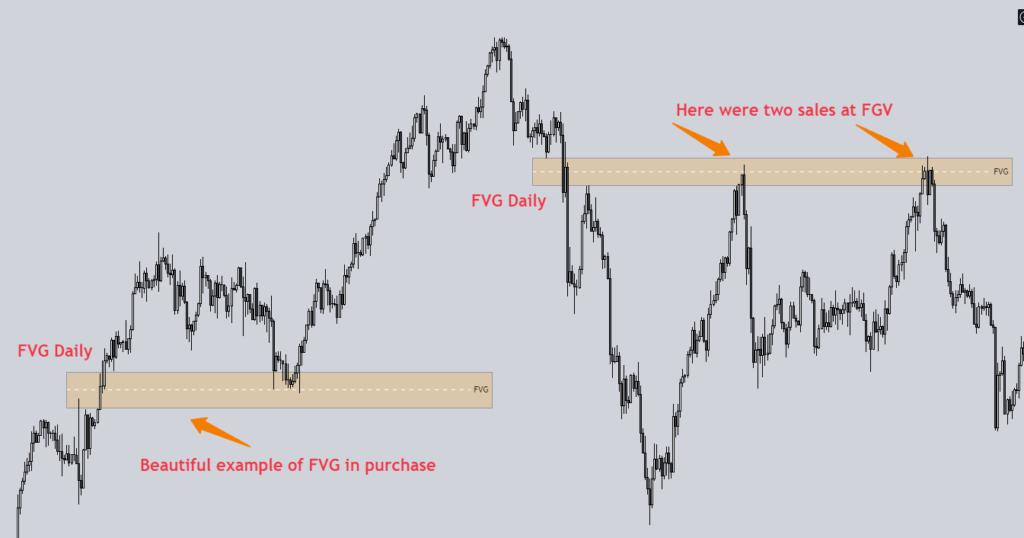

Strategy 4: Break of Structure Trend Ride 🚀

“Ride the institutional wave – without falling.”

Why it works:

A true BOS means the whales have voted – your job is to get in late and get out early.

Step by step (GBP/JPY example):

1️⃣ Chart setup: 1 hour + 15 minute combination (confirm BOS on HTF, enter on LTF).

2️⃣ Identify the breakout:

Uptrend: Price breaks 2 consecutive highs (BOS).

Downtrend: Breaks 2 lower lows (increasing volume = confirmation).

3️⃣ Wait for pullback, capture liquidity:

Ideal: Retest of bullish OB + 50% Fibonacci level.

Avoid: Unstable retracements > 61.8% Fibonacci.

4️⃣ Enter smart:

Buy only if the candle closes above the OB/Fibonacci zone.

5️⃣ Trailing Stop Magic:

Set the initial SL below the pullback low.

Move to breakeven with 1.5x risk.

Trail using the 3-bar low (for swings) or the ATR multiple (for trends).

🧠 Mindset tip:

“Be patient like a sniper, don’t compete with the market and respect your management; this method has great long-term returns.”

Pre-trading ritual: Trace the “perfect path” on the chart (train patience).

Post-trading rule: Wait 2 candles before the next trade (ends the fear of losing).

📈 Live example:

GBP/JPY April 2024 – BOS at 192.80 → 194.50 (RR 5:1 with trailing stop).

(Image Credits TradingView)

Strategy 5: Supply & Demand Flip 🔍

“Trade when the big boys flip sides.“

Why it slaps:

A real reversal means the institutional sentiment has done a complete 180 – and you’re front-running the retail crowd.

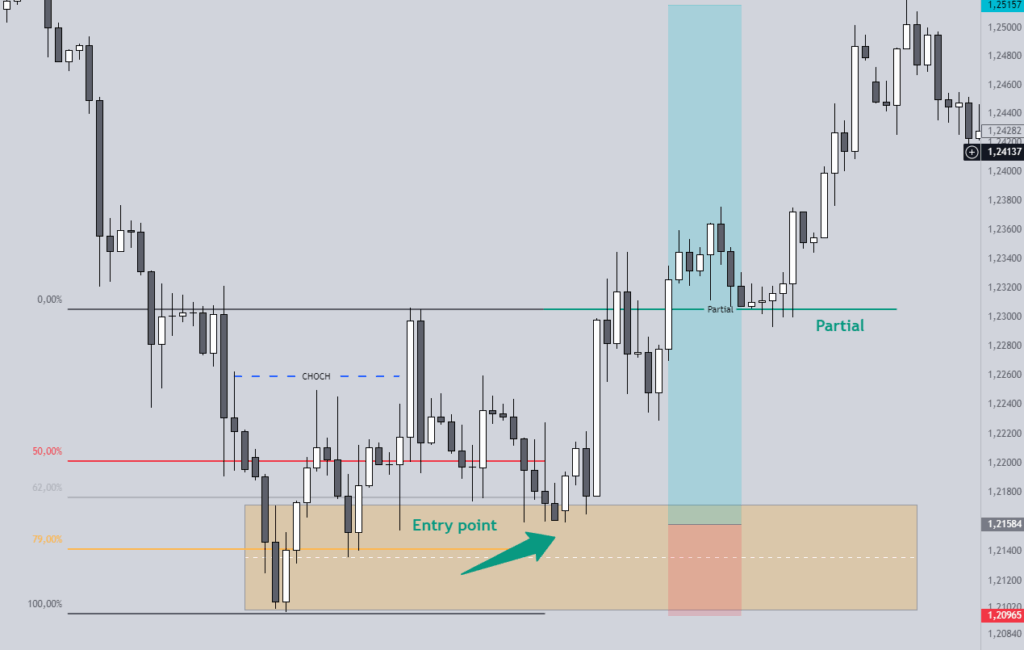

Step-by-step (AUD/USD example):

1️⃣ Chart Setup: Run a combo of the 4-hour chart plus the 1-hour (confirm the flip on the higher timeframe, get your entry on the lower timeframe).

2️⃣ Spot the Zone: Supply Zone: That area where price previously got smacked down with serious momentum (3+ bearish candles).

3️⃣ Wait for the Flip: Price needs to close above that supply zone twice (whales are soaking up all the selling pressure). Volume spike on the breakout = the juice is worth the squeeze.

4️⃣ Nail Your Entry: Go long only if the retest holds the 50-61.8% sweet spot of the new demand zone.

5️⃣ Risk Rules:

SL: Below the flip zone (that invalidates the whole damn reversal).

TP: Previous supply zone or a minimum risk/reward of 2 to 1.

🧠 Mindset Hack: “Jumping the gun feeds liquidity pools – be the trap, not the trapped.”

Confirmation Checklist:

- Zone retested as support two times.

- Higher low formed after the flip.

📉 Peep the example below: After the change of character (CHoCH) broke, price comes back for a double tap of the order block around the 62% fib level of the swing that caused the CHoCH. Price kisses the OB and then gets rejected hard – that’s where I slapped on my entry arrow, stop loss tucked below the OB, took partials at the CHoCH swing high, and the rest is history.”

How does that sound? I tried to keep the core message intact while making it sound like a trader talking to other traders in a US context. Let me know if you’d like any tweaks!

(Image Credits TradingView)

Why Mindset Is Key in SMC Trading 🧠

“Smart Money Concepts (SMC) is chess, not checkers – and your psychology is the queen on the board.”

The smart money sets up traps that hit those mental triggers we all got, it’s human nature, ya know? Triggers tied to FOMO (Fear Of Missing Out), straight-up greed (which sometimes ain’t even greed, it’s just need, self-pressure, or that fear of missing out on the action)… Here’s how to break that cycle:

✅ Patience, Bro: You only get real patience when you know yourself inside and out = Stacking Confluence.

Wait for 3 or more SMC signals to line up (like an Order Block + Break of Structure + volume spike).

✅ Emotional Control = Get a grip on your feels, man! Seriously, leash those emotions. We got tons of content about this right here on the blog. You can study the strat and drill the technique all day, but when push comes to shove, you ain’t gonna execute without a bulletproof mind. Interrupt those knee-jerk reactions and stop being a slave to your emotions – be you, be the awareness!

When you’re itching to chase a move, ask yourself: “Would the whales be jumping in right here?”

✅ Growth Mindset = Don’t come at the market like you’re begging for scraps. Nope! Come at it like a damn strategist. Be strong in spirit! Stand tall! Log your trades, dissect your losses like a scientist – “What did the market teach me today?” If you do that, you’ll never be the same chump. The market will forge you into someone strong and wise!

That’s Trader Emotional Excellence right there – To level up in this area and build a fortress in your mind, go crush the posts in our “Trader Psychology” category.

Grow big with SMC's trading strategies 🎉

“Trading like the institutions ain’t about being complicated as hell… it’s about seeing things crystal clear, having your discipline locked in, and straight-up managing your risk.“

✨ Build Your Game Plan:

- Order Blocks: Spot those institutional footprints. Watch if you’re getting entry triggers and rejections right at those Order Blocks.

- Snatch the Liquidity: Profit off those fakeouts. Train your eyes to see “liquidity grabs” – that’s the fuel the market runs on!

- Imbalances: Trade those “unfinished deals.”

- BOS Trends: Ride that momentum early.

- Supply/Demand Flips: Recognize when the sentiment’s doing a 180.

🚀 Next Level Moves:

- Practice Smart: Demo these setups on TradingView (it’s the go-to for SMC) or whatever platform you’re vibin’ with.

- Deep Dive on Mindset: Go read “How the Elite Traders Think” (Mistakes that Sabotage New Traders: How to Overcome Fear and Boost Profits).

- Join Our Tribe: Get weekly case studies dropped right in your inbox.

(We break down real charts – and real-deal trader psychology cases, just straight-up smart money insights.)”

“⚠️ Remember: This is education, not financial advice. Trading risks capital—always consult a professional. Ready to trade like the smart money? Join our free newsletter for weekly SMC insights! 📩”

Be the first to comment!